If you’ve been reading Linkage, you know that the classic car market has been on fire for the past two years. Mecum and Barrett-Jackson have been setting records at just about every auction outing, thanks to a market filled with great cars and buyers who just can’t seem to get enough. Big prices at auction for muscle and performance cars have pushed the needle even further — it’s an echo chamber of appreciation and value growth for well-tuned and well-timed examples.

On top of all that, here’s a new metric to consider: According to the Specialty Equipment Market Association (SEMA), aftermarket parts sales — carburetors, fuel injection systems, restoration parts, tires, wheels, brakes and the like — pushed past $50B in overall sales in 2021. That’s a new record — and it’s a big number. For comparison, in 2020, total sales rang in at $47.9B.

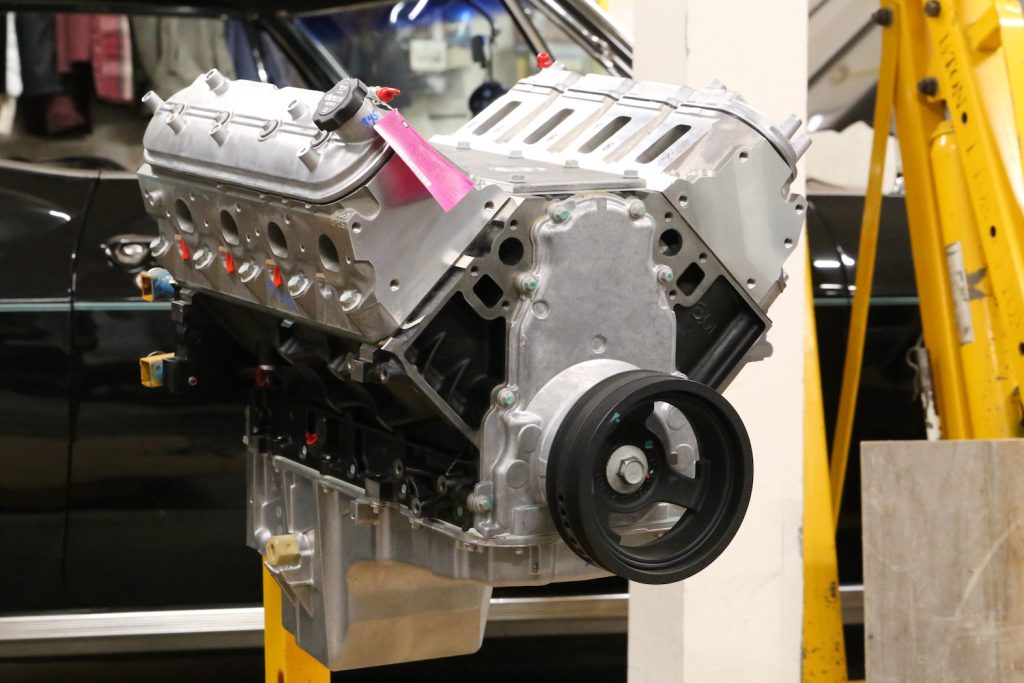

Of course, if you’ve been trying to build or restore something over the past few years, you might have already suspected this. Parts availability continues to be challenged by supply chain issues — but those long wait times we’ve all been enduring for our components wouldn’t have been so long had demand remained flat. When 2020 hit and people were forced to stay home, aftermarket parts sales spiked, and companies have been playing catch-up ever since.

SEMA has a few takeaways from their data. The first is that 80% of consumers polled reported spending more time working on their cars in 2021 than they did in 2020. Of those who bought parts, about 50% were done in-store versus online, which is up about 5% on the in-person side versus last year. Finally, and probably not surprisingly for those of you who have been watching the collector car auction scene, trucks remained the biggest segment among modified vehicles.

You can read SEMA’s report here.

Beyond the headline, it’s important to consider the climate in which all this is taking place. The stock market has been bouncing around, and the fed has raised interest rates in an effort to soften any potential hard market landing. Gas prices are sky-high and appear to be staying that way, at least in the short term, and auto manufacturers are pushing hard toward the electric scene — traditional hot-rod-like OEM efforts such as the Hellcat are not long for the world, to be replaced by an as-yet unannounced electric performance future. Even the Corvette has turned sparky. None of this exists in a vacuum.

I also think it’s important to look back at SEMA’s 2021 show, which polarized the audience by bringing a big heap of electric power into the mix. I can’t help but wonder if the reports of GM and Ford pulling out of the SEMA show for 2022, if they end up being true, have something to do with grand strategic directions that don’t exactly align with traditionalist values as seen in so many Instagram comments about electric power after the 2021 event. Or maybe it’s just that corporate spending needs to be refocused — even Mercedes-Benz, with the 300 SLR sale via RM Sotheby’s, is rethinking how it honors its past in an effort to push forward into the future.

Add all this up and it paints a pretty clear picture: The world is changing, but even if it’s more challenging and more expensive to build, restore or buy a hot rod or muscle car now than it was before the pandemic, the faithful are as devoted as ever. Their drive may even be greater than it used to be, and they’re not afraid to push financial boundaries to get what they want, even in these strange times. It sure looks to me like this heated market still has room to grow — both for cars and for parts.

If you’re a seller, that’s great news. If you’re a buyer, well, it’s not all bad, either.

For now, I wouldn’t bet on any slowdown of that market fire.

More Stories

The Future of Muscle

Finding GM Gold

Snapshots from Monterey